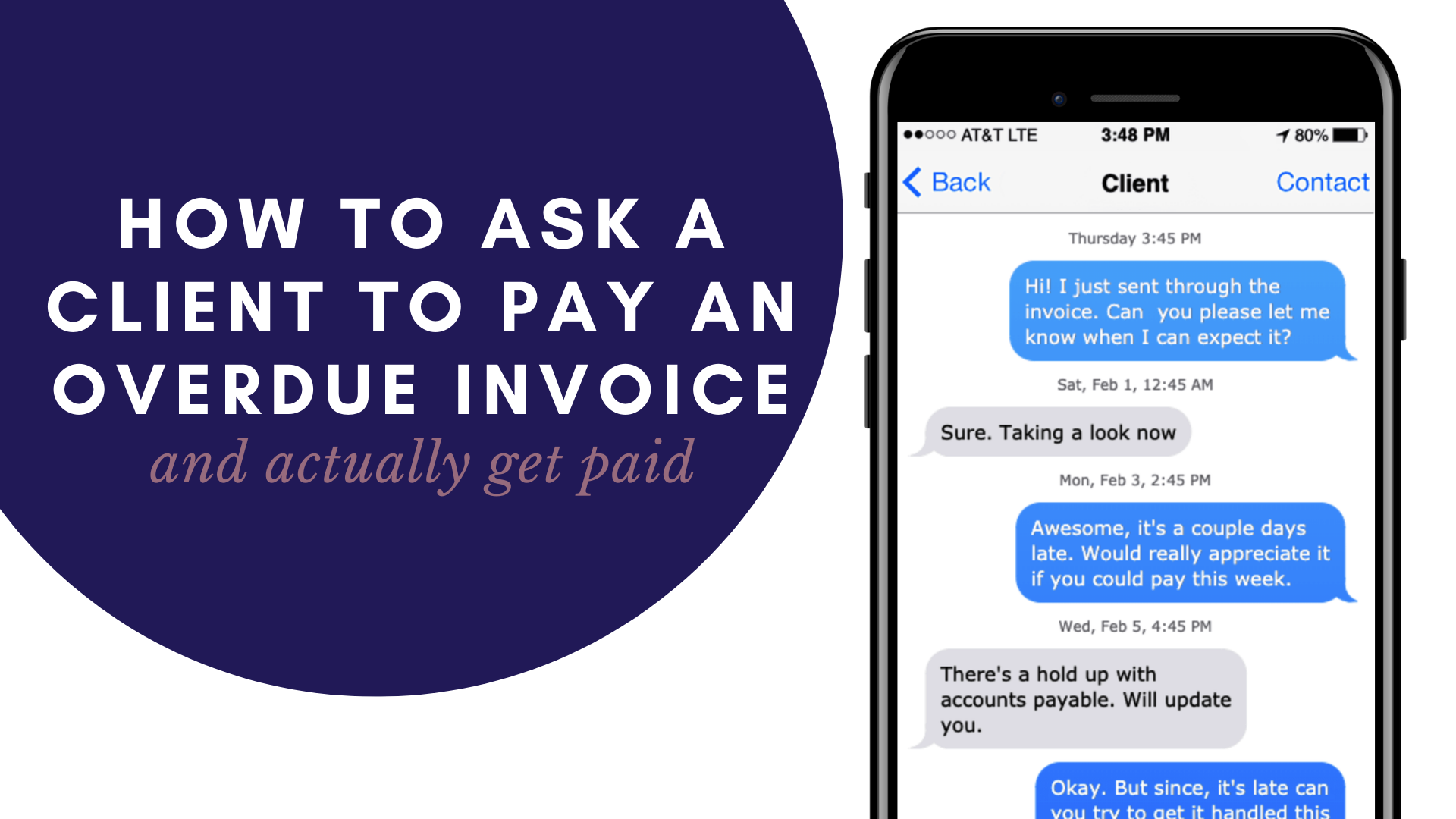

Nothing is more frustrating than an overdue invoice.

It turns what you hoped would be a pleasant interaction with the client into a challenging situation to navigate.

On one hand, you want to be respectful and professional.

But… on the other hand, you’re running a business and you know you deserve to get paid for the work you’ve done.

Are you just supposed to demand payment today? Should you send polite emails for months? What if they never respond?

Don’t worry. After sending hundreds of invoices as a copywriter, I’ve learned how to ask clients to make overdue payments … and, more importantly, actually get them to do so.

Below you’ll find email scripts, tools for automating your follow up and how to avoid overdue invoices in the future.

So whether your invoice is just a few days late and months past due, here’s how to get paid.

Emails scripts to remind a client to pay

Before we get into the scripts, we need to know just how late this invoice is.

Because if it’s a few days late, it requires a very different message than one that’s 60, 90, or more days overdue.

One could require a little nudge. Could be that they just forgot. Maybe Karen in accounting simply filed it wrong?

And others may require legal action. Yikes.

We’ll start with the least late (and the least aggressive) and move up the tier of follow up to the most overdue.

How to remind a client to pay an invoice that’s 1-7 days late.

If the invoice is just a little late, it’s best to be gentle, bring the past due invoice to their attention and ask clients for clarity on when to expect payment.

An easy script you can use is the following:

Hey [FIRST NAME], just wanted to check in on the status of this invoice below. It’s a couple days after the due date we had discussed and I didn’t see the payment come through.

No worries; we’re happy to waive the late fees. But do you have an ETA on when we should expect payment?

We know you’re busy, but even a short reply would really help our team of writers get clarity on next steps.

Thanks for understanding,

[YOUR NAME]

Why this script works:

- It’s clear. There’s no questioning that the payment is late and asks when the client when payment should be expected. When sending reminders, it’s tempting to beat around the bush. But you should seek clarity, ask questions directly, and don’t hide anything.

- You come across as friendly and agreeable. You may not know this, but whenever you send an invoice, you reserve the right to charge late fees for past due payments. In your friendly nudge, feel free to hint to the fact that you could charge late fees, but you’re going to waive them. This gives you power in the situation and turns down the dial on a potentially tense situation.

- It gives them permission to give a short reply. We’re all busy and sometimes even the thought of responding to another email is overwhelming. Notice how this script gives them permission to give a short reply. This is a key reason it almost always gets clients to respond.

Almost every time I send this email to a client, it wakes the client up to what’s going on.

For example, I had to send this to a client who was 5 days late on an $8,000+ invoice. Here’s the email I sent and their response.

See? It was a simple accounting mistake. We were paid the next week. Problem solved.

And nobody had to threaten to rip someone’s head off.

This gentle approach works whenever the client is just a few days late on payment.

However, when things move beyond a week late, you will need to turn up the dial on your email.

How to remind a client to pay an invoice that’s 8-30 days late.

If your invoice is more than a week overdue, it can be easy to lose your cool. But it’s extremely important to remain level headed when you ask for payment.

The reality is, if you show signs of frustration, the client may just say, “see you in court!”

Nobody wants that. So in your follow up here, I recommend you state facts clearly, try to empathize with the client and ask very clear yes/no questions about what to expect.

An easy script you can use is the following:

Hey [FIRST NAME],

We never want to be a thorn in your side and know what it’s like to be pinged again and again on an invoice.

But this invoice is [XX] days late and we haven’t heard from you.

In our time working together, we’ve always done our best to be prompt, turnaround work quickly and go the extra mile.

So as a small business owner to a fellow small business owner, can you let us know where things stand and how to proceed?

Thanks in advance,

[YOUR NAME]

Why this script works:

- You come across as likeable. By acknowledging that getting emails like this is annoying, you don’t make them feel bad. This builds rapport with the client and makes them feel as if you are starting from a place of understanding — NOT demanding.

- You talk about your working relationship and how you’ve always done your best to be quick. Conversely, they have not. By drawing attention to this fact, it will help the client see that you’ve done great things for them and deserve the courtesy of a response.

- It ends with a simple question that cannot be evaded. There’s almost nothing they can respond to this email other than

I have a 100% success rate with this email.

For example, I had to send this to a client who was 35 days late on an $5,000+ invoice. Here’s how the client responded.

Boom! We found out there was a delayed payment from a vendor and ate into their cash flow.

We were paid the next week. Problem solved.

And the best part is nobody had to threaten legal action or ruin the relationship. In fact, we still work with the client to this day!

This gentle approach works whenever the client is just a few days late on payment.

However, when things move beyond 30 days, you will need to take more extreme measures.

How to remind a client to pay an invoice that’s 31+ days late.

When an invoice is more than a month overdue, it can drive you crazy. Your mood might swing from anger and rage to wondering what you did wrong?

And if an invoice is this much overdue, there is a chance it’ll never get paid, which is a hard pill to swallow.

But there are some things I’ve learned for getting even the most overdue, unresponsive clients to respond. It takes empathy, offering options and being extremely clear about next steps.

Here’s the script:

Hey [FIRST NAME],

I know what it’s like to be pinged again and again on an invoice. But it’s been a while since we’ve heard from you. And this invoice is [XX] days past due.

We want to be accommodating but can only flex on our payment terms so much.

So if you’re unable to pay the invoice in full at this time, we wanted to offer you the ability to split it into two parts — with half due today and the remaining half due in 30 days (with a 7% financing fee).

If this option works for you, I will shoot through the first half of the invoice right now and send the next one in 15 days.

How does that sound?

Thanks in advance,

[YOUR NAME]

Why this script works:

- You are not demanding payment. You’re offering the option to split it up into a couple payments. This makes you seem agreeable and understanding, which goes a long way.

- You draw a hard line in the sand by saying, “we can only flex on our payment terms so much.” Without saying it aggressively, this communicates that you are done with the back and forth and delays.

- It ends with a simple question that cannot be evaded. There’s almost nothing the client can respond to this email other than what should happen next.

This an email of last resort and should only really be sent when the client is showing signs that they will not pay.

By offering financing, you could get at least some of the money instead of nothing at all.

For example, I had to send this to a client who was 60+ days late on an $10,000+ invoice. Here’s how the client responded.

🙏

The client made a partial payment! We were truly grateful for it because we’d written it off at a loss.

But they also explained their situation to us and let us know that they were thrilled with our work. This helped us know more about their situation and ultimately let us know we needed to back off and give them time.

Pro tip: Use automation to remind a clients when you can

In the above examples, I showed you direct emails to write to your clients to get them to pay.

But I also strongly recommend using tools like Quickbooks, Freshbooks or whatever your invoicing software is to give them automated nudges along the way.

These emails come across far less abrasive and can be scheduled in advance so you don’t even have to think about them.

Generally, I like to send them:

- 1 week before the invoice is due

- 2 days before the invoice is due

- The day it’s due

These automated reminders can be a simple and straightforward way to nudge clients without you having to stay on top of due dates.

How to avoid situations like this in the future

When you have an invoice that’s overdue, all you want is to get it paid.

But the ultimate goal is to never have to send emails like this.

If you want to learn more about how to attract clients that always pay on time, consider 30 Days to $9K.

It’s a freelance copywriting course that shows you how to

- Land high-paying clients

- Write converting copy

- And make a living writing online

In as little as 30 days.

Oh yeah, and it’ll show you how to avoid the whole “late invoice” thing in the first place.

See why 100s of freelancers choose it for all their freelance training.